The contents of this document should not be perceived as investment advice.

Why should investors consider natural capital?

Contents

Portfolio benefits

Natural capital can offer both long-established investment attributes and emerging strategic advantages:

Low correlation with traditional equities and bonds

Inflation protection through real asset exposure

Capital preservation via productive, finite land resources

Attractive risk adjusted returns supported by biological growth and low volatility

These benefits are well-recognised in agriculture and forestry. Increasingly, however, natural capital is also valued for its role in climate adaptation, regulatory alignment, and systemic risk mitigation, positioning it as a resilience anchor within institutional portfolios.

01a

Low correlation with traditional assets

Natural capital assets have consistently demonstrated low correlation with public markets. Their returns are largely driven by biological growth cycles, land productivity and commodity trends rather than macroeconomic shocks. This makes them powerful tools for portfolio diversification.

Correlation matrix of real and traditional assets 1995-2024

Equities

Bonds

Gold

Farmland

US Forestry

REITs

UK

Forestry

Inflation

-0.10

-0.21

0.05

0.27

0.31

-0.28

0.13

1.00

0.18

1.00

0.02

0.32

1.00

0.07

0.08

-0.28

0.82

-0.10

0.23

-0.09

1.00

1.00

0.57

0.24

0.10

-0.14

-0.04

1.00

-0.27

0.05

0.08

-0.18

-0.12

0.04

1.00

1.00

Equities

Bonds

Gold

Farmland

US Forestry

REITs

UK Forestry

Inflation

1

0.75

0.50

0.25

0

-0.25

-0.50

-0.75

-1

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Office for National Statistics; Gresham House. Full source in references section. Past performance is not a guarantee or reliable indicator of future results.

01b

Capital preservation

Sustainably managed natural assets tend to retain or grow their intrinsic value over time. Their productivity is tied to essentials like food, fibre and raw materials, goods with persistent demand. These assets generate stable, uncorrelated income streams, helping to cushion portfolio losses during periods of financial market distress, such as the dot-com crash and the 2008 Global Financial Crisis.

Maximum drawdown by asset (from 1995-2024)

Farmland

US Forestry

Bonds

UK Forestry

Gold

S&P 500

REITs

-1.46%

-4.83%

-17.24%

-19.86%

-40.64%

-49.81%

-57.46%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

Max drawdown

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Gresham House. Past performance is not a guarantee or reliable indicator of future results.

01c

Inflation hedge

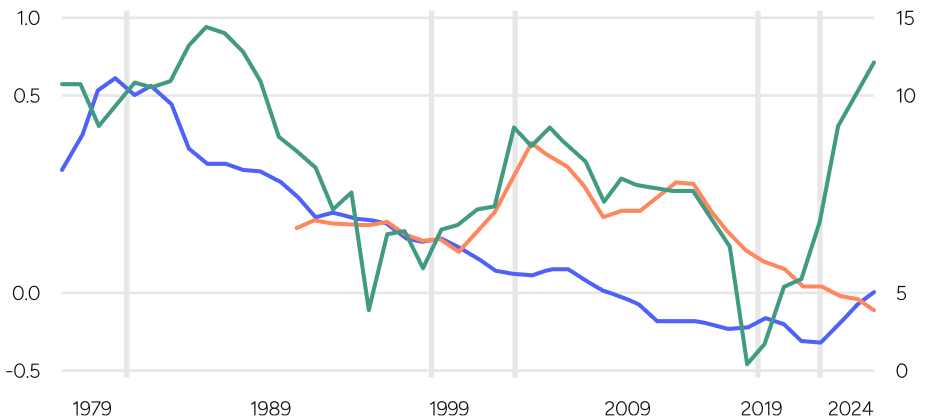

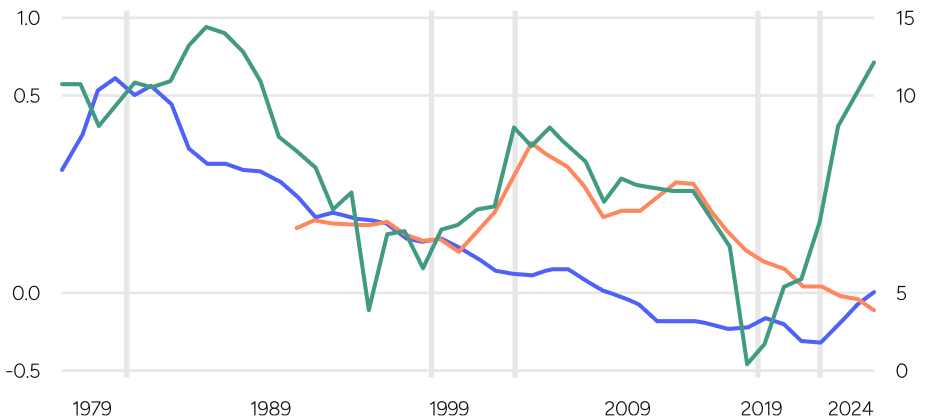

Natural capital strategies offer strong inflation protection. Revenues from farmland and timberland are typically linked to commodity prices or inflation-indexed leases. As real assets, they help preserve purchasing power in inflationary environments.

Rolling 10-year correlation between inflation and farmland, with smoothed income and 10y treasury yield

KEY

Correlations

10y treasury yield

Smoothed farmland and income

Sources: NCREIF Farmland Index (total return); Office for National Statistics (UK CPI); Federal Reserve Economic Data (U.S. 10Y Treasury yield); Gresham House calculations. Past performance is not a guarantee or reliable indicator of future results.

01d

Attractive risk adjusted returns

Natural capital assets such as agriculture and forestry have historically outperformed equities and bonds on a risk-adjusted basis, with superior Sharpe ratios across regions and cycles. Performance data for nature-based solutions is still limited but developing.

Historical risk-adjusted volatility metrics (30-year)

Asset name

Mean Return

Volatility

Sharpe Ratio

Farmland

9.01%

7.01%

0.93

US Forestry

7.80%

7.02%

0.76

UK Forestry

11.57%

12.64%

0.72

Equities

11.83%

18.94%

0.49

REITs

9.46%

19.63%

0.35

Gold

6.48%

14.64%

0.27

Bonds

4.73%

8.29%

0.27

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Gresham House. Past performance is not a guarantee or reliable indicator of future results.

01e

Climate alignment and portfolio resilience

Net zero targets are reshaping capital flows, regulation and investor mandates. Natural capital plays a critical role in delivery. Indeed, while emissions reductions remain essential, there is a growing recognition that carbon removal will also be vital to meet mid-century goals. Nature-based solutions are among the few scalable options for high-integrity removals, with afforestation, peatland restoration, and coastal projects generating credits for compliance and voluntary use. Sustainable agriculture and forestry also contribute through soil carbon gains and extended rotation cycles. These assets offer investors the flexibility to retain credits for internal decarbonisation or to monetise them, creating both financial and reputational value aligned with long-term climate goals.

92%

of LGPS respondents indicated, that in addition to financial returns, contributing to climate adaptation and mitigation is a leading reason to invest in natural capital.

(Gresham House and Mallow Street, 2024)

*An exchange rate of USD 1.00 = GBP 0.75 was applied for conversion purposes (02/09/2025).

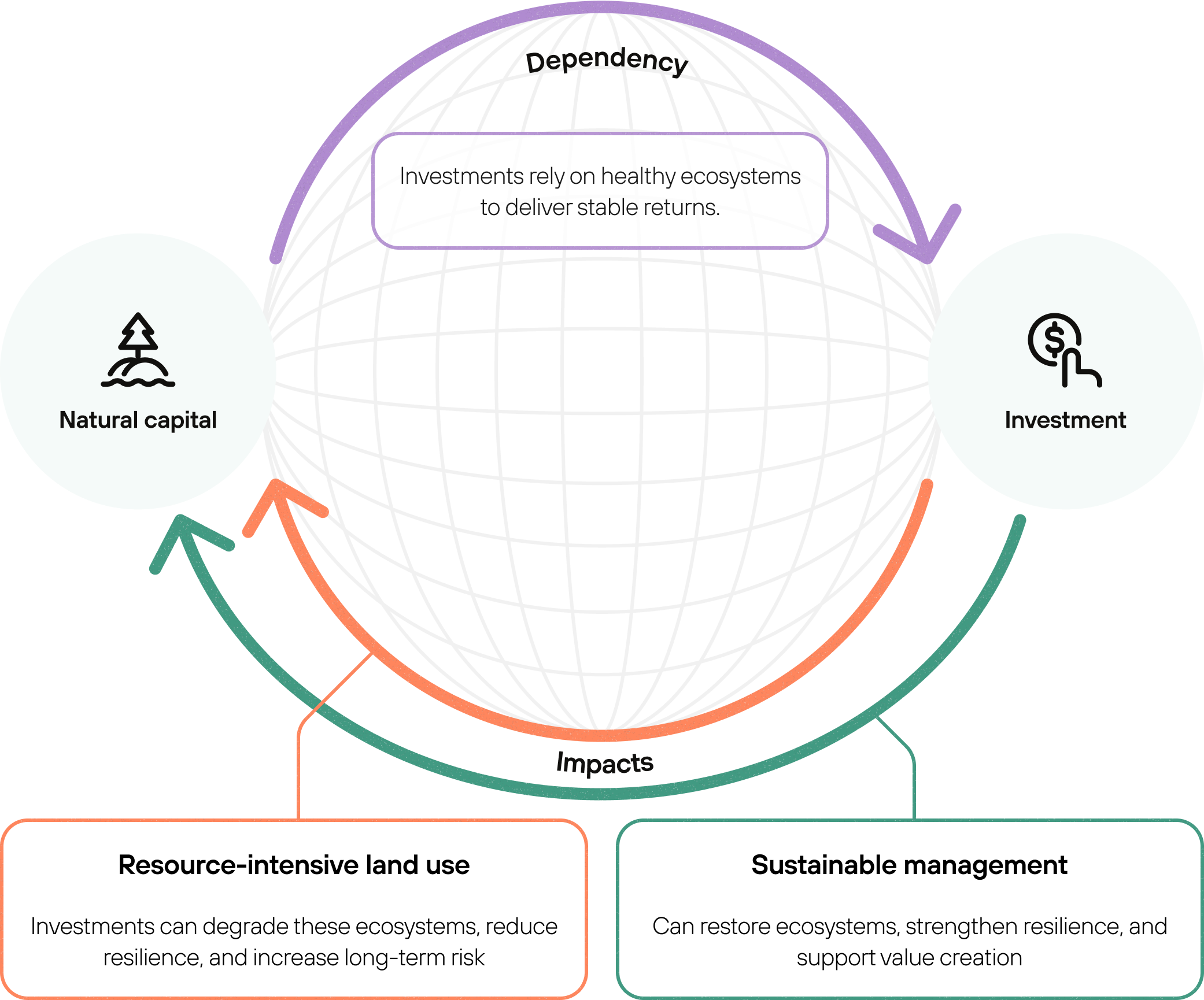

Investments depend on ecosystems, and also influence those systems, both positively and negatively.

01f

Governance, disclosure and, ESG alignment

Natural capital can support ESG goals by mitigating systemic environmental risks, enhancing biodiversity, and strengthening rural economies. It aligns with regulatory frameworks such as ISSB, SFDR and, TNFD, helping investors meet growing disclosure requirements and integrate nature-related risks. Legal guidance from NatWest Cushion and Eversheds Sutherland confirms that pension trustees can consider broader economic and social factors, including climate change, when acting in members’ interests (Dohle, 2025). By delivering both measurable impact and financial returns, natural capital offers a practical route to align fiduciary duty with long-term sustainability commitments.

92%

of LGPS respondents indicated, that in addition to financial returns, contributing to climate adaptation and mitigation is a leading reason to invest in natural capital.

(Gresham House and Mallow Street, 2024)

Essex Pension Fund has invested in timberland as part of its £1 billion impact investing strategy, targeting a 4% allocation and securing carbon credits through this commitment (Room 151, 2023; Pensions Age, 2022).

Structural opportunities

Several long-term trends are reinforcing the strategic relevance of natural capital.

02a

Climate volatility

Climate change is amplifying the frequency and severity of extreme weather events, placing mounting pressure on production systems, infrastructure, and supply chains. These disruptions are reshaping global markets.

For well-capitalised investors, this is creating clear opportunities to deploy capital into resilience. From a land-based perspective, this includes owning sustainable land and water assets that can endure, or benefit from, climatic shifts, investing in climate-resilient production systems and infrastructure. In the face of volatility, assets that can dampen its impact while delivering consistent, reliable output or benefit (e.g. flood defense, drought mitigation) will capture disproportionate value, reinforcing a “winner-takes-all” dynamic that rewards resilience.

The intensity of droughts and floods is rising as global temperatures rise

Intensity of droughts and floods (km3 month)

8,000

6,000

4,000

2,000

0

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

2023

2025

+ 0.5°C

+ 1.3°C

Temperature above pre-industrial mean

Source: (Rodell et al., 2023; Global Water Intelligence and Xylem, 2025)

Source: (Rodell et al., 2023; Global Water Intelligence and Xylem, 2025)

5.7m

properties in England (1 in 6 businesses and homes) are now at risk of flooding.

(Environment Agency, 2023)

02b

Population growth and food security

Rising populations and changing diets are placing sustained pressure on food systems. At the same time, regulation and consumer demand are driving a shift towards agricultural models that reduce emissions and environmental harm. This is reinforcing long-term investor interest in productive, regenerative land use.

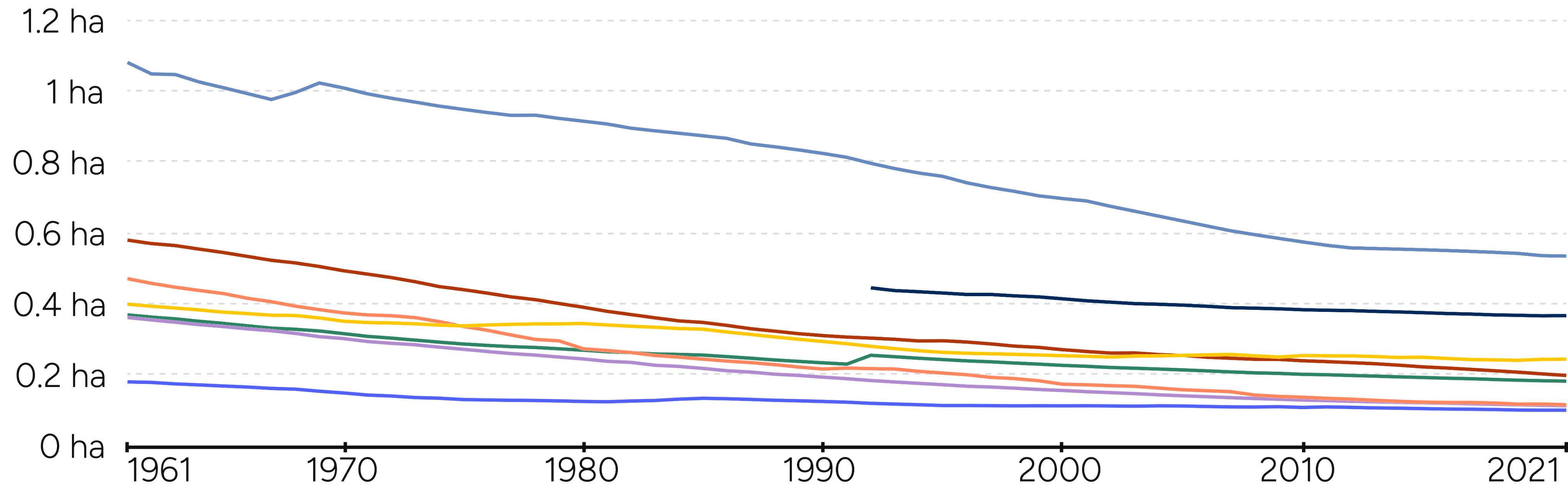

Agricultural land per capita since 1961 (Ritchie and Roser, 2019)

2023

2030

Animal protein & feed

1.2x

Minerals 4x

Renewables

15x

Biofuels & Plastic

4x

Food & Fibre

1.2x

Source: BloombergNEF (uses the same population, GDP and food demand assumptions in both scenarios. Total land demand comparison is illustrative as demand categories are not necessarily additive. Renewables are wind and solar, biofuels include plastics).

02c

Land and water scarcity

Climate change, degradation and rising demand are intensifying pressure on land and freshwater. Agriculture’s reliance on water is straining global reserves, making resource-efficient, regenerative assets more valuable. Water scarcity is also disrupting industries such as utilities and manufacturing, raising costs and constraining growth across economies (World Economic Forum, 2024).

Agricultural land per capita since 1961 (Ritchie and Roser, 2019)

KEY

North America

Europe and Central Asia

Latin America and Caribbean

Sub-Saharan Africa

World

Middle East and North Africa

South Asia

East Asia and Pacific

Source: (Ritchie and Roser, 2019)

02d

Deglobalisation and regional resilience

Net zero targets are reshaping capital flows, regulation and investor mandates. Natural capital plays a critical role in delivery. Indeed, while emissions reductions remain essential, there is a growing recognition that carbon removal will also be vital to meet mid-century goals. Nature-based solutions are among the few scalable options for high-integrity removals, with afforestation, peatland restoration, and coastal projects generating credits for compliance and voluntary use. Sustainable agriculture and forestry also contribute through soil carbon gains and extended rotation cycles. These assets offer investors the flexibility to retain credits for internal decarbonisation or to monetise them, creating both financial and reputational value aligned with long-term climate goals.

02e

Carbon market access

and policy exposure

As net-zero targets expand, demand is growing for land-based carbon removals backed by clear standards and policy support. Strategies such as afforestation, peatland restoration and, blue carbon are generating verifiable credits for compliance and voluntary markets. These projects offer long-term revenue potential tied to regulation and decarbonisation goals, with return profiles distinct from traditional asset classes. However, carbon pricing remains volatile and difficult to fully bank today, meaning that revenue forecasts should be approached with caution.

24%

of global emissions are covered by a carbon market, while 76% of emissions are covered by a net-zero target.

(WorldBank, 2024; Committee on Climate Change, 2025)

These trends are not cyclical, they’re structural. Together, they point to sustained demand for natural capital investments that combine resilience, productivity and measurable environmental value.

The contents of this document should not be perceived as investment advice.

Why should investors consider natural capital?

Contents

Portfolio benefits

Natural capital can offer both long-established investment attributes and emerging strategic advantages:

Low correlation with traditional equities and bonds

Inflation protection through real asset exposure

Capital preservation via productive, finite land resources

Attractive risk adjusted returns supported by biological growth and low volatility

These benefits are well-recognised in agriculture and forestry. Increasingly, however, natural capital is also valued for its role in climate adaptation, regulatory alignment, and systemic risk mitigation, positioning it as a resilience anchor within institutional portfolios.

01a

Low correlation with traditional assets

Natural capital assets have consistently demonstrated low correlation with public markets. Their returns are largely driven by biological growth cycles, land productivity and commodity trends rather than macroeconomic shocks. This makes them powerful tools for portfolio diversification.

Correlation matrix of real and traditional assets 1995-2024

Equities

Bonds

Gold

Farmland

US Forestry

REITs

UK

Forestry

Inflation

-0.10

-0.21

0.05

0.27

0.31

-0.28

0.13

1.00

0.18

1.00

0.02

0.32

1.00

0.07

0.08

-0.28

0.82

-0.10

0.23

-0.09

1.00

1.00

0.57

0.24

0.10

-0.14

-0.04

1.00

-0.27

0.05

0.08

-0.18

-0.12

0.04

1.00

1.00

Equities

Bonds

Gold

Farmland

US Forestry

REITs

UK Forestry

Inflation

1

0.75

0.50

0.25

0

-0.25

-0.50

-0.75

-1

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Office for National Statistics; Gresham House. Full source in references section. Past performance is not a guarantee or reliable indicator of future results.

01b

Capital preservation

Sustainably managed natural assets tend to retain or grow their intrinsic value over time. Their productivity is tied to essentials like food, fibre and raw materials, goods with persistent demand. These assets generate stable, uncorrelated income streams, helping to cushion portfolio losses during periods of financial market distress, such as the dot-com crash and the 2008 Global Financial Crisis.

Maximum drawdown by asset (from 1995-2024)

Farmland

US Forestry

Bonds

UK Forestry

Gold

S&P 500

REITs

-1.46%

-4.83%

-17.24%

-19.86%

-40.64%

-49.81%

-57.46%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

Max drawdown

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Gresham House. Past performance is not a guarantee or reliable indicator of future results.

01c

Inflation hedge

Natural capital strategies offer strong inflation protection. Revenues from farmland and timberland are typically linked to commodity prices or inflation-indexed leases. As real assets, they help preserve purchasing power in inflationary environments.

Rolling 10-year correlation between inflation and farmland, with smoothed income and 10y treasury yield

KEY

Correlations

10y treasury yield

Smoothed farmland and income

Sources: NCREIF Farmland Index (total return); Office for National Statistics (UK CPI); Federal Reserve Economic Data (U.S. 10Y Treasury yield); Gresham House calculations. Past performance is not a guarantee or reliable indicator of future results.

01d

Attractive risk adjusted returns

Natural capital assets such as agriculture and forestry have historically outperformed equities and bonds on a risk-adjusted basis, with superior Sharpe ratios across regions and cycles. Performance data for nature-based solutions is still limited but developing.

Historical risk-adjusted volatility metrics (30-year)

Asset name

Mean Return

Volatility

Sharpe Ratio

Farmland

9.01%

7.01%

0.93

US Forestry

7.80%

7.02%

0.76

UK Forestry

11.57%

12.64%

0.72

Equities

11.83%

18.94%

0.49

REITs

9.46%

19.63%

0.35

Gold

6.48%

14.64%

0.27

Bonds

4.73%

8.29%

0.27

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Gresham House. Past performance is not a guarantee or reliable indicator of future results.

01e

Climate alignment and portfolio resilience

Net zero targets are reshaping capital flows, regulation and investor mandates. Natural capital plays a critical role in delivery. Indeed, while emissions reductions remain essential, there is a growing recognition that carbon removal will also be vital to meet mid-century goals. Nature-based solutions are among the few scalable options for high-integrity removals, with afforestation, peatland restoration, and coastal projects generating credits for compliance and voluntary use. Sustainable agriculture and forestry also contribute through soil carbon gains and extended rotation cycles. These assets offer investors the flexibility to retain credits for internal decarbonisation or to monetise them, creating both financial and reputational value aligned with long-term climate goals.

£420–458bn*

of LGPS respondents indicated, that in addition to financial returns, contributing to climate adaptation and mitigation is a leading reason to invest in natural capital.

(Gresham House and Mallow Street, 2024)

*An exchange rate of USD 1.00 = GBP 0.75 was applied for conversion purposes (02/09/2025).

Investments depend on ecosystems, and also influence those systems, both positively and negatively.

Natural capital

Investment

Resource-intensive land use

Investments can degrade these ecosystems, reduce resilience, and increase long-term risk

Sustainable management

Can restore ecosystems, strengthen resilience, and support value creation

Investments rely on healthy ecosystems to deliver stable returns.

01f

Governance, disclosure and, ESG alignment

Natural capital can support ESG goals by mitigating systemic environmental risks, enhancing biodiversity, and strengthening rural economies. It aligns with regulatory frameworks such as ISSB, SFDR and, TNFD, helping investors meet growing disclosure requirements and integrate nature-related risks. Legal guidance from NatWest Cushion and Eversheds Sutherland confirms that pension trustees can consider broader economic and social factors, including climate change, when acting in members’ interests (Dohle, 2025). By delivering both measurable impact and financial returns, natural capital offers a practical route to align fiduciary duty with long-term sustainability commitments.

92%

of LGPS respondents indicated, that in addition to financial returns, contributing to climate adaptation and mitigation is a leading reason to invest in natural capital.

(Gresham House and Mallow Street, 2024)

Essex Pension Fund has invested in timberland as part of its £1 billion impact investing strategy, targeting a 4% allocation and securing carbon credits through this commitment (Room 151, 2023; Pensions Age, 2022).

Structural opportunities

Several long-term trends are reinforcing the strategic relevance of natural capital.

02a

Climate volatility

Climate change is amplifying the frequency and severity of extreme weather events, placing mounting pressure on production systems, infrastructure, and supply chains. These disruptions are reshaping global markets.

For well-capitalised investors, this is creating clear opportunities to deploy capital into resilience. From a land-based perspective, this includes owning sustainable land and water assets that can endure, or benefit from, climatic shifts, investing in climate-resilient production systems and infrastructure. In the face of volatility, assets that can dampen its impact while delivering consistent, reliable output or benefit (e.g. flood defense, drought mitigation) will capture disproportionate value, reinforcing a “winner-takes-all” dynamic that rewards resilience.

The intensity of droughts and floods is rising as global temperatures rise

Intensity of droughts and floods (km3 month)

8,000

6,000

4,000

2,000

0

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

2023

2025

+ 0.5°C

+ 1.3°C

Temperature above pre-industrial mean

Source: (Rodell et al., 2023; Global Water Intelligence and Xylem, 2025)

Source: (Rodell et al., 2023; Global Water Intelligence and Xylem, 2025)

5.7m

properties in England (1 in 6 businesses and homes) are now at risk of flooding.

(Environment Agency, 2023)

02b

Population growth and food security

Rising populations and changing diets are placing sustained pressure on food systems. At the same time, regulation and consumer demand are driving a shift towards agricultural models that reduce emissions and environmental harm. This is reinforcing long-term investor interest in productive, regenerative land use.

Agricultural land per capita since 1961 (Ritchie and Roser, 2019)

2023

2030

Animal protein & feed

1.2x

Minerals 4x

Renewables

15x

Biofuels & Plastic

4x

Food & Fibre

1.2x

Source: BloombergNEF (uses the same population, GDP and food demand assumptions in both scenarios. Total land demand comparison is illustrative as demand categories are not necessarily additive. Renewables are wind and solar, biofuels include plastics).

02c

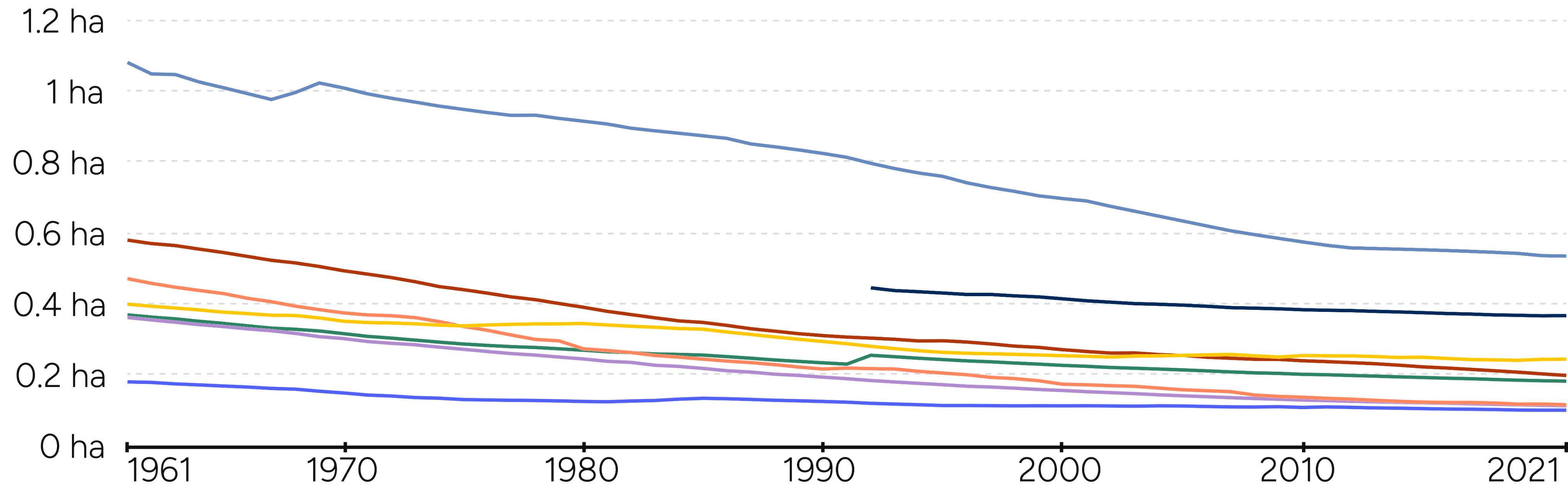

Land and water scarcity

Climate change, degradation and rising demand are intensifying pressure on land and freshwater. Agriculture’s reliance on water is straining global reserves, making resource-efficient, regenerative assets more valuable. Water scarcity is also disrupting industries such as utilities and manufacturing, raising costs and constraining growth across economies (World Economic Forum, 2024).

Agricultural land per capita since 1961 (Ritchie and Roser, 2019)

KEY

North America

Europe and Central Asia

Latin America and Caribbean

Sub-Saharan Africa

World

Middle East and North Africa

South Asia

East Asia and Pacific

Source: (Ritchie and Roser, 2019)

02d

Deglobalisation and regional resilience

Net zero targets are reshaping capital flows, regulation and investor mandates. Natural capital plays a critical role in delivery. Indeed, while emissions reductions remain essential, there is a growing recognition that carbon removal will also be vital to meet mid-century goals. Nature-based solutions are among the few scalable options for high-integrity removals, with afforestation, peatland restoration, and coastal projects generating credits for compliance and voluntary use. Sustainable agriculture and forestry also contribute through soil carbon gains and extended rotation cycles. These assets offer investors the flexibility to retain credits for internal decarbonisation or to monetise them, creating both financial and reputational value aligned with long-term climate goals.

02e

Carbon market access

and policy exposure

As net-zero targets expand, demand is growing for land-based carbon removals backed by clear standards and policy support. Strategies such as afforestation, peatland restoration and, blue carbon are generating verifiable credits for compliance and voluntary markets. These projects offer long-term revenue potential tied to regulation and decarbonisation goals, with return profiles distinct from traditional asset classes. However, carbon pricing remains volatile and difficult to fully bank today, meaning that revenue forecasts should be approached with caution.

24%

of global emissions are covered by a carbon market, while 76% of emissions are covered by a net-zero target.

(WorldBank, 2024; Committee on Climate Change, 2025)

These trends are not cyclical, they’re structural. Together, they point to sustained demand for natural capital investments that combine resilience, productivity and measurable environmental value.

The contents of this document should not be perceived as investment advice.

Why should investors consider natural capital?

Contents

Portfolio benefits

Natural capital can offer both long-established investment attributes and emerging strategic advantages:

Low correlation with traditional equities and bonds

Inflation protection through real asset exposure

Capital preservation via productive, finite land resources

Attractive risk adjusted returns supported by biological growth and low volatility

These benefits are well-recognised in agriculture and forestry. Increasingly, however, natural capital is also valued for its role in climate adaptation, regulatory alignment, and systemic risk mitigation, positioning it as a resilience anchor within institutional portfolios.

01a

Low correlation with traditional assets

Natural capital assets have consistently demonstrated low correlation with public markets. Their returns are largely driven by biological growth cycles, land productivity and commodity trends rather than macroeconomic shocks. This makes them powerful tools for portfolio diversification.

Correlation matrix of real and traditional assets 1995-2024

Equities

Bonds

Gold

Farmland

US Forestry

REITs

UK

Forestry

Inflation

-0.10

-0.21

0.05

0.27

0.31

-0.28

0.13

1.00

0.18

1.00

0.02

0.32

1.00

0.07

0.08

-0.28

0.82

-0.10

0.23

-0.09

1.00

1.00

0.57

0.24

0.10

-0.14

-0.04

1.00

-0.27

0.05

0.08

-0.18

-0.12

0.04

1.00

1.00

Equities

Bonds

Gold

Farmland

US Forestry

REITs

UK Forestry

Inflation

1

0.75

0.50

0.25

0

-0.25

-0.50

-0.75

-1

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Office for National Statistics; Gresham House. Full source in references section. Past performance is not a guarantee or reliable indicator of future results.

01b

Capital preservation

Sustainably managed natural assets tend to retain or grow their intrinsic value over time. Their productivity is tied to essentials like food, fibre and raw materials, goods with persistent demand. These assets generate stable, uncorrelated income streams, helping to cushion portfolio losses during periods of financial market distress, such as the dot-com crash and the 2008 Global Financial Crisis.

Maximum drawdown by asset (from 1995-2024)

Farmland

US Forestry

Bonds

UK Forestry

Gold

S&P 500

REITs

-1.46%

-4.83%

-17.24%

-19.86%

-40.64%

-49.81%

-57.46%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

Max drawdown

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Gresham House. Past performance is not a guarantee or reliable indicator of future results.

01c

Inflation hedge

Natural capital strategies offer strong inflation protection. Revenues from farmland and timberland are typically linked to commodity prices or inflation-indexed leases. As real assets, they help preserve purchasing power in inflationary environments.

Rolling 10-year correlation between inflation and farmland, with smoothed income and 10y treasury yield

KEY

Correlations

10y treasury yield

Smoothed farmland and income

Sources: NCREIF Farmland Index (total return); Office for National Statistics (UK CPI); Federal Reserve Economic Data (U.S. 10Y Treasury yield); Gresham House calculations. Past performance is not a guarantee or reliable indicator of future results.

01d

Attractive risk adjusted returns

Natural capital assets such as agriculture and forestry have historically outperformed equities and bonds on a risk-adjusted basis, with superior Sharpe ratios across regions and cycles. Performance data for nature-based solutions is still limited but developing.

Historical risk-adjusted volatility metrics (30-year)

Asset name

Mean Return

Volatility

Sharpe Ratio

Farmland

9.01%

7.01%

0.93

US Forestry

7.80%

7.02%

0.76

UK Forestry

11.57%

12.64%

0.72

Equities

11.83%

18.94%

0.49

REITs

9.46%

19.63%

0.35

Gold

6.48%

14.64%

0.27

Bonds

4.73%

8.29%

0.27

Sources: NCREIF; FTSE Nareit; LBMA; S&P Dow Jones Indices; Bloomberg; Bank of England; Gresham House. Past performance is not a guarantee or reliable indicator of future results.

01e

Climate alignment and portfolio resilience

Natural capital enables both decarbonisation and climate adaptation by providing access to carbon removal solutions such as afforestation and soil restoration, alongside land assets that support biodiversity and ecosystem stability. As ecosystems decline, long-term portfolio impacts are becoming more visible and measurable (University of Exeter and Institute and Faculty of Actuaries, 2025). These strategies help deliver net zero targets, manage physical climate risks, and strengthen long-term portfolio resilience. This flexibility adds to the strategic value of natural capital, aligning climate goals with the fundamentals of real asset investing.

£420–458bn*

of LGPS respondents indicated, that in addition to financial returns, contributing to climate adaptation and mitigation is a leading reason to invest in natural capital.

(Gresham House and Mallow Street, 2024)

*An exchange rate of USD 1.00 = GBP 0.75 was applied for conversion purposes (02/09/2025).

Investments depend on ecosystems, and also influence those systems, both positively and negatively.

Natural capital

Investment

Resource-intensive land use

Investments can degrade these ecosystems, reduce resilience, and increase long-term risk

Sustainable management

Can restore ecosystems, strengthen resilience, and support value creation

Investments rely on healthy ecosystems to deliver stable returns.

01f

Governance, disclosure and, ESG alignment

Natural capital can support ESG goals by mitigating systemic environmental risks, enhancing biodiversity, and strengthening rural economies. It aligns with regulatory frameworks such as ISSB, SFDR and, TNFD, helping investors meet growing disclosure requirements and integrate nature-related risks. Legal guidance from NatWest Cushion and Eversheds Sutherland confirms that pension trustees can consider broader economic and social factors, including climate change, when acting in members’ interests (Dohle, 2025). By delivering both measurable impact and financial returns, natural capital offers a practical route to align fiduciary duty with long-term sustainability commitments.

92%

of LGPS respondents indicated, that in addition to financial returns, contributing to climate adaptation and mitigation is a leading reason to invest in natural capital.

(Gresham House and Mallow Street, 2024)

Essex Pension Fund has invested in timberland as part of its £1 billion impact investing strategy, targeting a 4% allocation and securing carbon credits through this commitment (Room 151, 2023; Pensions Age, 2022).

Structural opportunities

Several long-term trends are reinforcing the strategic relevance of natural capital.

02a

Climate volatility

Climate change is amplifying the frequency and severity of extreme weather events, placing mounting pressure on production systems, infrastructure, and supply chains. These disruptions are reshaping global markets.

For well-capitalised investors, this is creating clear opportunities to deploy capital into resilience. From a land-based perspective, this includes owning sustainable land and water assets that can endure, or benefit from, climatic shifts, investing in climate-resilient production systems and infrastructure. In the face of volatility, assets that can dampen its impact while delivering consistent, reliable output or benefit (e.g. flood defense, drought mitigation) will capture disproportionate value, reinforcing a “winner-takes-all” dynamic that rewards resilience.

The intensity of droughts and floods is rising as global temperatures rise

Intensity of droughts and floods (km3 month)

8,000

6,000

4,000

2,000

0

2003

2005

2007

2009

2011

2013

2015

2017

2019

2021

2023

2025

+ 0.5°C

+ 1.3°C

Temperature above pre-industrial mean

Source: (Rodell et al., 2023; Global Water Intelligence and Xylem, 2025)

Source: (Rodell et al., 2023; Global Water Intelligence and Xylem, 2025)

5.7m

properties in England (1 in 6 businesses and homes) are now at risk of flooding.

(Environment Agency, 2023)

02b

Population growth and food security

Rising populations and changing diets are placing sustained pressure on food systems. At the same time, regulation and consumer demand are driving a shift towards agricultural models that reduce emissions and environmental harm. This is reinforcing long-term investor interest in productive, regenerative land use.

Land use requirements increase between 2023 and 2030

2023

2030

Animal protein & feed

1.2x

Minerals 4x

Renewables

15x

Biofuels & Plastic

4x

Food & Fibre

1.2x

Source: BloombergNEF (uses the same population, GDP and food demand assumptions in both scenarios. Total land demand comparison is illustrative as demand categories are not necessarily additive. Renewables are wind and solar, biofuels include plastics).

02c

Land and water scarcity

Climate change, degradation and rising demand are intensifying pressure on land and freshwater. Agriculture’s reliance on water is straining global reserves, making resource-efficient, regenerative assets more valuable. Water scarcity is also disrupting industries such as utilities and manufacturing, raising costs and constraining growth across economies (World Economic Forum, 2024).

Agricultural land per capita since 1961

KEY

North America

Europe and Central Asia

Latin America and Caribbean

Sub-Saharan Africa

World

Middle East and North Africa

South Asia

East Asia and Pacific

Source: (Ritchie and Roser, 2019)

02d

Deglobalisation and regional resilience

Geopolitical shocks, pandemics and supply chain disruptions have exposed vulnerabilities in global trade. In response, governments and businesses are prioritising domestic production and resource security. Agriculture, forestry and nature-based infrastructure are increasingly seen as strategic assets, supporting economic resilience and national self-sufficiency.

02e

Carbon market access and policy exposure

As net-zero targets expand, demand is growing for land-based carbon removals backed by clear standards and policy support. Strategies such as afforestation, peatland restoration and, blue carbon are generating verifiable credits for compliance and voluntary markets. These projects offer long-term revenue potential tied to regulation and decarbonisation goals, with return profiles distinct from traditional asset classes. However, carbon pricing remains volatile and difficult to fully bank today, meaning that revenue forecasts should be approached with caution.

24%

of global emissions are covered by a carbon market, while 76% of emissions are covered by a net-zero target.

(WorldBank, 2024; Committee on Climate Change, 2025)

These trends are not cyclical, they’re structural. Together, they point to sustained demand for natural capital investments that combine resilience, productivity and measurable environmental value.